Investor Impact Accelerator

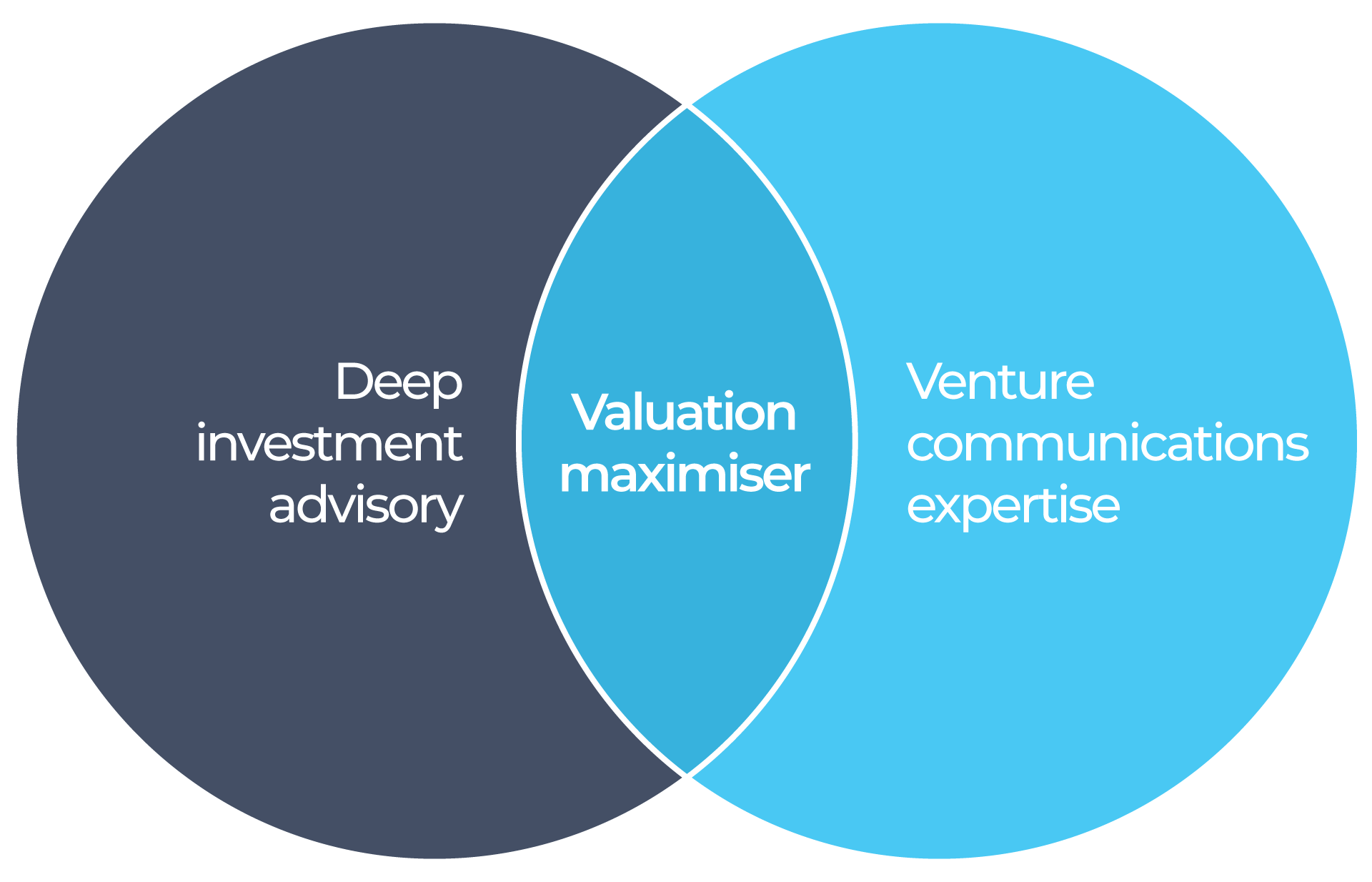

Grounded in decades of experience, our unique offering delivers hands-on guidance across investment markets, corporate optimisation, communications and marketing frameworks. This synchronised model services strategic growth needs while capitalising on funding opportunities with ongoing tactical execution. Surgical, lean, tailored to your current evolution.

-

Investment Markets Guidance

-

Corporate Optimisation

-

Investor Communications

-

Marketing & Growth Frameworks

Scenarios we address

-

Near-Term Capital Raise

You are interested in maximising the value of your existing investor network.

You are growing a business that needs capital to support it’s journey.

-

Mid-Term Capital & Sustained Growth Needs

You are preparing for future fundraising to maximise valuation.

You are building investor and general market familiarity with your story, targeting a raise in 12–18 months.

-

Post Raise Investment and General Market Engagement

You are focusing on delivering on promises and driving ongoing growth.

You are maintaining confidence across investors, community, and customers through strategic alignment.

-

Exit Management

You are maximising business value to prepare for a successful exit.

You need support with deal structuring, due diligence, and succession planning.

You are positioning the business optimally in the market through appropriate media and communications.

Companies we have supported in their investor & communications Journey

At any stage, a business needs expertise in investment, strategy, growth, and corporate affairs. You can start leveraging our expertise at any stage in your journey, from early stage through to external investment, and beyond. We begin by seeking a deep understanding of your business and needs.

Our Investor Impact Accelerator can support all areas of strategic planning, execution, and communication, including:

How we meet your unique needs

-

Capital-raising strategy by leveraging deep capital markets experience.

-

Relationship-building initiative advisory, including certain investor relations efforts and collaborations.

-

Advisory support including capital raising decks, financials, due diligence material, deal structuring, corporate optimisation and general capital raising activities.

-

PR support, including media outreach strategies, editorial strategy, and distribution across all media formats supporting your products and clients.

-

Coaching on presentation skills and investor pitches.

-

Governance, Company Secretarial & Risk Management Frameworks.

-

The development of core narratives and promotional frameworks to integrate investor and commercial messaging.

-

Support with managing logistics and delivery for webinars, community events, and investor presentations.

-

Internal and investor communications support, intertwining with general marketing and promotional activities.

-

Corporate Optimisation Services including Management Consulting, Director Services & Mentoring.

Expertise you can count on

Our team combines decades of expertise in capital markets, communications, and investor relations. We understand the nuances of capital-raising, from governance and compliance to effective storytelling. Meet the experts who will guide you through your journey:

Jonathan Englert

Founder

A seasoned communications strategist and venture company operator, Jonathan specialises in disruptive technology and innovative industries.

He has pioneered a new communications model that harnesses data science and the qualitative strengths of the immersive journalistic method to drive outsized and lasting gains for a range of organisational needs. Known for pioneering a data-driven, journalistic communications model, he has advised companies on profile expansion and market growth.

Within Andiron Group’s portfolio, Jonathan is co-founder of Good & Fugly, a purpose-driven venture championing sustainability and social impact.

As a journalist, he’s contributed to The New York Times and authored The Collar, praised by The Chicago Tribune. Award-winning, he holds a PhD from the University of Sydney, an M.S. from Columbia, and a B.A. from Bard College.

Yema Akbar

Director

With over 10 years in institutional sales, marketing, and venture capital, Yema has led brand growth and editorial strategy across deep tech, renewable energy, enterprise software, and business advisory.

Starting at Colonial First State, he joined the founding team at Crescent Wealth to help grow funds under management to $300M in assets across managed investment schemes and superannuation.

He has worked at First Quay Capital, a boutique private equity group focused on the fintech and hospitality sectors.

In 2017 Yema launched e-commerce start-up MR.KOYA, an irreverent men’s fashion brand that gained national and viral attention.

At Andiron Group since 2018, he oversees brand, PR, and editorial frameworks across a range of ventures from early stage to ASX listed. Yema holds a double degree in Applied Finance and Economics from Macquarie University.

Cameron Petricevic

Investor Adviser

Cameron has spent over 20 years in the financial industry, and as a Board member of both private and public companies.

He has investment banking experience, including mergers & acquisitions, valuations, initial public offerings and portfolio management coupled with growing early stage companies.

He has held previous roles at AXA Asia Pacific (acquired by AMP), Acorn Capital and as a Partner at Kentgrove Capital. Cameron is currently a Director/Founder at Lucrum Ventures.

Having raised in excess of $100m across ASX and private markets, he has considerable experience with capital raising strategy, coaching, and business strategic consulting.

Cameron is a qualified Actuary (AIAA), holds a Bachelor of Commerce (Actuarial) and a Bachelor of Engineering (Electrical) from the University of Melbourne, with First Class Honours. He is also a Graduate of the Australian Institute of Company Directors (GAICD).

Contact us

Sydney, Australia

info@andirongroup.com

+61 412 150 040 (AUS)

1 646 583 1650 (US)